Osram Accelerates Its Technological Shift and Explores Future Markets

“The first half of the fiscal year was challenging due to various factors. However, the long-term growth trend remains intact, while the reorganization and the technological shift are continuing,” said Olaf Berlien, CEO of OSRAM Licht AG.

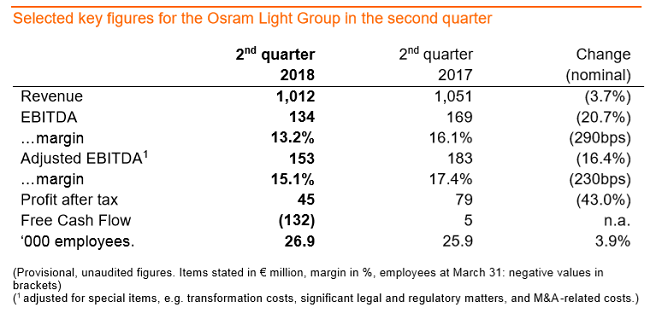

Osram generated slight growth in the second quarter of fiscal year 2018. At €1.01 billion, revenue on a comparable basis was up by 1.8 percent year-on-year. EBITDA adjusted for special items amounted to €153 million, which was below the figure reported a year earlier. The adjusted EBITDA margin reached 15.1 percent. In the second quarter, the company’s financial position was affected by persistently strong exchange-rate effects and some market factors. Irrespective of the short-term effects, Osram has chosen the right strategy, under which it is focusing on semiconductor-based high-tech products. Moreover, the group has acquired other companies in order to expand its technology portfolio in areas with high potential for the future.

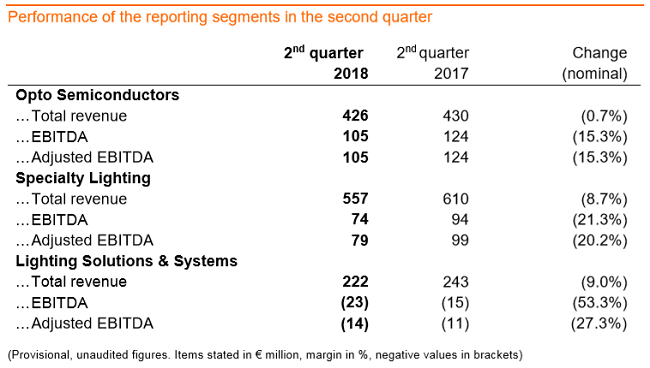

A look at the segments shows that the latest market trends and the continued weakness of the US dollar are impacting on current business. Meanwhile the new factory in Kulim is stepping up production as scheduled and has secured its first big-ticket customers in the Americas, Europe, and Asia. The site’s development is progressing as planned and the predicted volume production will be reached toward the end of the fiscal year.

Osram recently enhanced its semiconductor-based lighting and laser technology portfolio by acquiring Vixar. This US provider of advanced VCSEL technology will add compact 3D identification technology to the Osram product range and will offer significant synergies. Vixar is a fabless semiconductor company and has developed a supply chain consisting of merchant foundries.

Of late, Specialty Lighting (SP) has increasingly seen a shift from conventional headlamps, such as halogen or xenon, to cutting-edge LED solutions. At the same time, the business unit has been expanding its range of lighting for plants. To strengthen this business unit, Osram has acquired the specialty lighting provider Fluence. Based in Austin, Texas, Fluence develops and sells luminaires used in the cultivation of vegetables and medicinal plants. Its products will expand Osram’s horticulture portfolio (see separate press release).

There have been no indications of a fundamental trend reversal in the performance of the Lighting Solutions & Systems (LSS) segment. Demand for luminaires, electronic ballasts, and services remains weak in this segment. In the first instance, the Managing Board is tackling the critical aspect of the LS business unit, initiating the sale of the service business in the US. The relevant documentation for prospective buyers is currently being compiled.

Adjusted outlook for the full fiscal year

Last week, Osram adjusted its outlook for the current fiscal year. Based on current exchange rates, a comparable revenue increase of 3.0–5.0 percent (previously: 5.5–7.5 percent) and adjusted EBITDA of ~€640 million (previously: ~€700 million) are now forecast. Furthermore, Osram expects earnings per share (diluted) of €1.90–€2.10 (previously: €2.40–€2.60) and a negative free cash flow of €50 million to €150 million (unchanged) for fiscal year 2018.