Yole Développement "Status of the LED Industry" Shows that Low Price LED Solutions Are Pushing Technology Adoption Toward General Lighting

Yole Développement is pleased to announce the third edition of one of its best seller: Status of the LED Industry. In this 2013 edition, Yole Développement mixes technical analysis, market trends, forecasts, geographical analysis...and much more! With a first part dedicated to general lighting, and a second one focused on other applications, discover the different format of the report and choose the part you need!

General lighting applications have taken off:

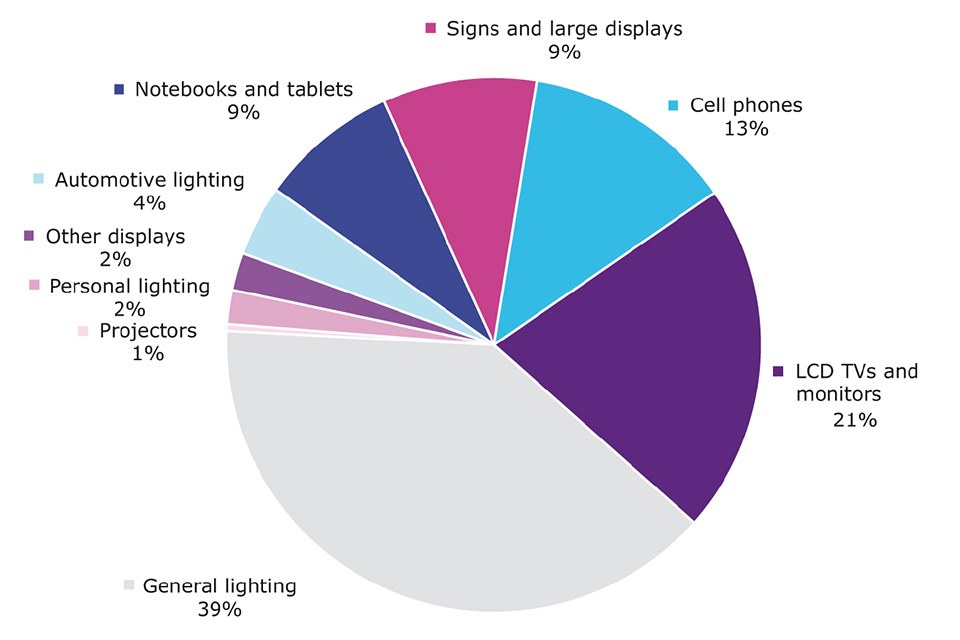

Growth of the LED industry has come initially from the small display application and has been driven forward by the LCD display application. In 2012, General lighting has surpassed all other applications, representing nearly 39% of total revenue of packaged LEDs. Indeed, the LED TV crisis of 2011 (following an overestimation of the market) had the benefit of decreasing LED prices and intensifying the competitive environment. As a matter of fact, LED-based lighting product prices have decreased more rapidly than expected, increasing the penetration rate of the technology.

Yole Développement estimates packaged LED will reach a market size of $13.9B in 2013 and will peak to $16B by 2018. Growth will be driven mainly by general lighting applications (45% to 65% of total revenue during this period), completed by display applications.

Other applications are still in motion:

Regarding display and other applications, most products currently on the market integrate LED technology. Saturation mixed with strong price pressure and competition from OLED will make most of these markets decline starting from 2013 / 2014. Contrary to general lighting, overcapacity (inducing price pressure) has engendered a decrease in market size more rapidly than predicted.

This report presents all applications of LED and associated market metrics within the period 2008-2020, detailing for each application: drivers & challenges, associated volume and market size (packaged LED, LED die surface), penetration rate of LEDs, and alternative technologies. For general lighting, a deeper analysis is developed with details on each market segment.

To keep the momentum, LED-based lighting product costs still need to be reduced

“Cost represents the main barrier LEDs must overcome to fully compete with incumbent technologies”, explains Pars Mukish, Market and technology analyst, LED at Yole Développement. “Since 2010, the price of packaged LEDs have sharply decreased, which has had the consequence of decreasing the price of LED-based lighting products”, he adds.

However, to maintain the growth trajectory, more efforts are needed in terms of price. LED still has some potential for cost reduction, but widespread adoption will also require manufacturers to play on all components of the system (drivers, heat sink, PCB).

The report presents LED-based lighting product cost reduction opportunities, detailing: cost structure of packaged LED and LED lamp, key technologies and research areas.

Merger of LED industry with lighting industry has started:

Over the past 3 years (2010 to 2012), the number of mergers and acquisitions has continuously grown, reflecting the increased consolidation of the LED industry. During this period, we have listed ~60 significant M&A deals. And 17 additional deals have already been identified during H1-2013.

Main objectives of these deals are:

Vertical integration

A consistent trend in the LED space, reinforced by the promising boom of general lighting applications. Such deals are motivated by the need for companies to access to new technologies, to close knowledge gaps in the LED supply chain, secure supply.

Strategic acquisition

The LED lighting market remains highly fragmented in all regions of the world (i.e., local features of fixtures…). In this environment, strategic acquisitions are mainly motivated by economies of scale, desire for improved market share, access to a wider customer portfolio, and increase the sales force.

Geographical acquisition

Mergers and acquisitions, rather than organic growth, have proved to be the main market-entry strategy by overseas acquirers. Such deals have been driven primarily by companies seeking access to new markets and local distribution networks.

The number of mergers and acquisitions deals is likely to continue to grow as LED technology hascreated a Solid State Lighting (SSL) chasm, modifying all traditional aspects of the lighting industry (light source, system design, test¡K) and forcing supply chain players to acquire new competencies.

The report presents the LED industry, detailing: evolution of supply and value chain, reactor capacity by region, analysis of M&A deals.

Emerging substrates could change the rules in an industry dominated by sapphire

Sapphire (and SIC) remain the most widely used substrates for GaN epitaxy but many research teams are working on finding better alternatives in terms of performance and total cost of ownership. In that context, Si and GaN are the main new substrates developed in the LED industry:

Benefits of GaN-on-Si LEDs rely on decreasing manufacturing cost by using cheaper Silicon substrate but mainly by switching to an 8¡¨ substrate and using fully depreciated and highly automated CMOS fabs.

Benefits of GaN-on-GaN LEDs stem from the lower defect density in the epitaxial layers, allowing the device to be driven at higher current levels and to use a lower number of LED devices per system.

However, several barriers need to be overcome:

GaN-on-Si LEDs are closer to GaN-on-Sapphire LED performance but increased manufacturing yields and full compatibility with CMOS fab still need to be achieved.

GaN-on-GaN LEDs suffer from GaN substrate availability and its cost.

While GaN (GaN-on-GaN LEDs) holds some potential on specific high-end niches, we consider Silicon (GaN-on-Si LEDs) as the more serious contender as a potential alternative to the widespread use of Sapphire. But the success of GaN-on-Si LEDs will depend on the development of associated LEDs performance and development of manufacturing techniques.

The report presents GaN-on-Si and GaN-on-GaN LED technologies, detailing: benefits and challenges, status (¡K).

About the report:

Author:

Pars Mukish holds a master degree in Materials Science & Polymers and a master degree in Innovation & Technology Management (EM Lyon ¡V France). He works at Yole Developpement as Market and Technology Analyst in the fields of LED, Lighting Technologies and Compound Semiconductors to carry out technical, economic and marketing analysis. Previously, he has worked as Marketing & Techno-Economic Analyst at the CEA (French Research Center).

Format available:

Full report - Multi user license / General Lighting part / Other applications part / Single user license / Executive Summary

Publication date: September 2013

For special offers and the price in dollars, please contact David Jourdan (jourdan@yole.fr).