OLED Technology in Lighting Applications

Prototypes and niche applications with OLEDs for lighting have been demonstrated over the past few years. Now there are indications that OLED technology is ready for mass production or at least will be ready very soon. Franco Musiari, Technology Specialist at ASSODEL analyzed the current status and future perspectives of OLED technology.

OLEDs are often presented as the light source of the future which makes them a direct competitor of LEDs. The name suggests that they are just a special variety of LEDs. An OLED (Organic Light Emitting Diode) is a solid-state light generator in which emission occurs when current passes through the layers of organic materials of which it is made up, similar to LEDs.

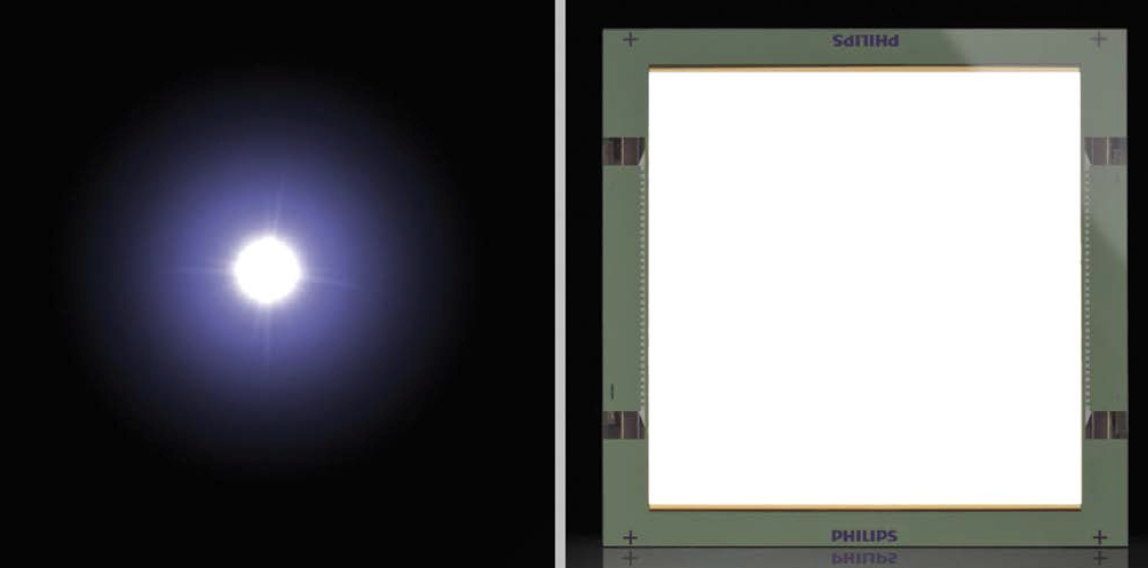

Both OLEDs and LEDs transform electrical energy into light by means of a semi-conductive material, but that is where the similarity ends. OLEDs come in the form of extremely thin panels - 0.8 to 2 mm - in various sizes starting from 50.50 mm2. In an LED, the light source is concentrated in just a few square millimeters – of course, we’re talking about single chips – and hence almost punctiform, while the brightness of an OLED is distributed over the entire surface of the panel.

This is the basic difference that makes the OLED appealing: diffused light that DoEs not glare or project hard shadows but rather, generates uniform lighting. This characteristic is not easy to achieve with LEDs, nonetheless, LEDs have their advantages for all other lighting requirements. That means that instead of being in competition with one another, LED and OLED products complement each other. Figure 1: While at Light+Building 2008 only a few OLED based products were on display, in 2010 the numbers almost exploded, and in 2012 virtually all lighting companies displayed OLED luminaires

Figure 1: While at Light+Building 2008 only a few OLED based products were on display, in 2010 the numbers almost exploded, and in 2012 virtually all lighting companies displayed OLED luminaires

Figure 2: In the OLED, light is emitted from the entire surface; in the LED, the light source is almost punctiform

Figure 2: In the OLED, light is emitted from the entire surface; in the LED, the light source is almost punctiform

Technical Differences between OLEDs and LEDs in Detail

There are several aspects in which OLEDs differ from LEDs. For instance, how they dissipate generated heat. In LEDs, the energy not transformed into light is turned into heat that is concentrated in the small crystal of which it is made up. In OLEDs, the same phenomenon occurs, but the heat, like the light, is evenly distributed over the entire surface of the panel.

Hence, while in LEDs it is mandatory to have a system capable of removing the heat from the LED to prevent it from overheating and thus reducing its life, in OLEDs this problem is not posed. The heat in OLEDs is naturally dispersed across the entire surface of the panel and DoEs not require any particular heat removing measure.

In LEDs, the wavelength generated is closely tied to the physical characteristics of the crystal which is the heart of emission. For this reason, an LED not aided by phosphors always and only generates a certain wavelength, or rather a precise color. Typically, “white” is obtained with LEDs that generate in blue and then doing a conversion to lower wavelengths using the phosphors that cover them.

In OLEDs, the generation mechanism is tied to each single emission molecule and DoEs not require a crystalline structure. The various organic materials that generate the light can be appropriately mixed in the emission layer to obtain the desired color.

Efficiency of OLEDs

One of the marketing arguments often cited by manufacturers of OLEDs for lighting is that they save energy. This, of course, has to do with the expressed luminous efficiency. Some predict that OLEDs will reach efficiencies of 90-100 lm/W by 2015. Fortunately, the evidence of the last few years is that the efficiency of OLEDs is on an upward curve, but has not yet reached levels that can confirm the marketing targets.

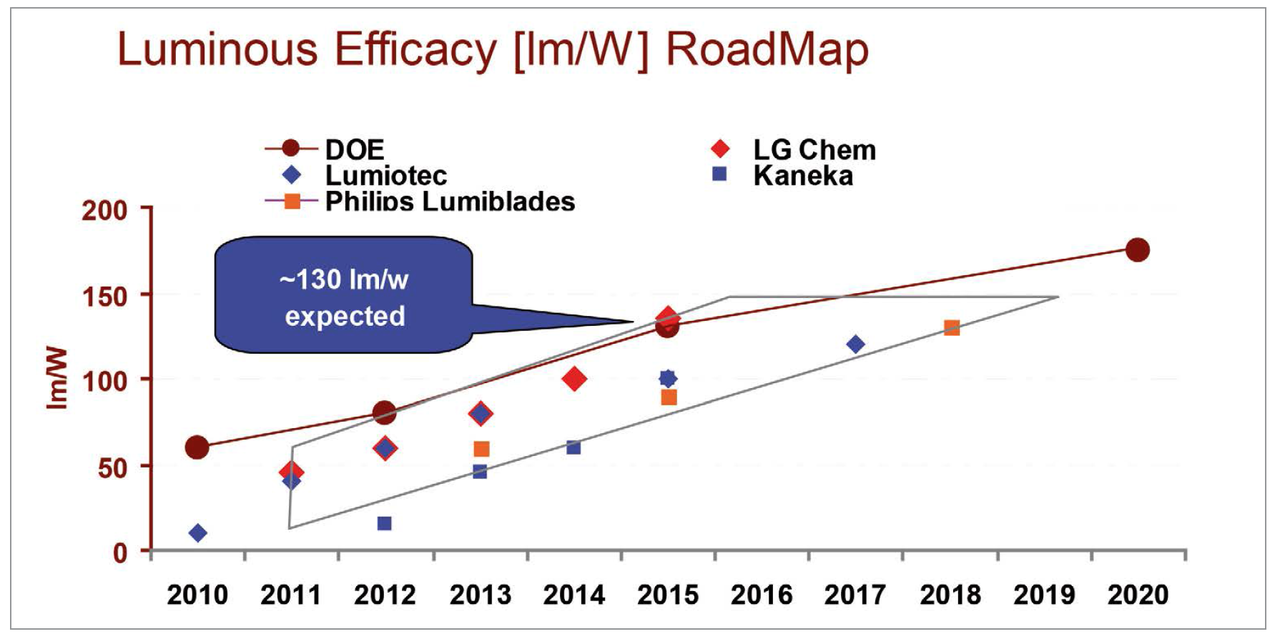

Figure 3: Roadmap of some OLED manufacturers with reference to luminous efficiency

Figure 3: Roadmap of some OLED manufacturers with reference to luminous efficiency

In order to maximize the energy efficiency of an OLED, you need to find the right compromise with other characteristics, such as lifetime, color quality, size and cost. For example, in 2012 Panasonic presented a panel with an efficiency of 142 lm/W. However, the panel surface area was only 4 mm2 and the technology adopted did not allow application on larger surfaces.

Referring to products already on the market, we can talk about efficiencies of:

• 23 lm/W at 1,000 cd/m2 with CCT of 2,800 K for the Osram Orbeos CDW-031, one of the first panels that appeared on the market in 2010;

• 40/45 lm/W at 6,500 / 4,000 cd/m2 with CCT of 3,200 K for the Lumiblade GL350 (data updated to April 2013 for product availability in the second half of 2013);

• 40 lm/W at 3,000 cd/m2 with CCT of 2,800 K for the Lumiotec P05 series;

• 45 lm/W at 3,000 cd/m2 with CCT of 4,000 K for the LG Chem N4SA40;

• 60 lm/W at 3,000 cd/m2 with CCT of 4,000 K for the LG Chem N6SA40;

However, the graph in figure 3 which joins the roadmaps of some big names in the sector shows further improvements are expected in 2013.

Kaneka expects to reach 60 lm/W this year with LG Chem predicting 80 lm/W. If we look ahead to 2015 we see Philips Lumiblade predicts that they will reach 90 lm/W while LG Chem’s goal is 135 lm/W. These levels justify using OLED lighting for energy saving.

Lifetime Comparison to LEDs

This is the other critical parameter that still causes confusion in the lighting communities. This is especially so if the comparison is made with LEDs that now easily reach 30,000-50,000 hours (L70).

Today’s vague claims like “The lifetime should reach 40,000 hours in a few years’ time” indicate that we are still a long way from ceasing comparing OLEDs with LEDs. Looking at the same panels analyzed above, we find that:

• The Osram CDW-031 declares three L50 values (i.e. 50% of the initial brightness):

o 5,000 hours @ 1,000 cd/m2

o 10,000 hours @ 500 cd/m2 and

o 15,000 hours @ 250 cd/m2.

• The Philips GLT350 declares an L70 of 10,000 hours @ 4,000 cd/m2 and 6,000 hours @ 6,500 cd/m2.

• The Lumiotec P05 series shows an L70 of 25,000 hours @ 1,000 cd/m2 and 5,000 hours at 3,000 cd/m2.

• The LG Chem N4SA40 indicates an L70 of 10,000 hours @ 3,000 cd/m2.

• The LG Chem N6SA40 indicates an L70 of 15,000 hours @ 3,000 cd/m2. The latter is the most recent (but not that recent) model and already shows an improvement of 50% on the expected lifetime.

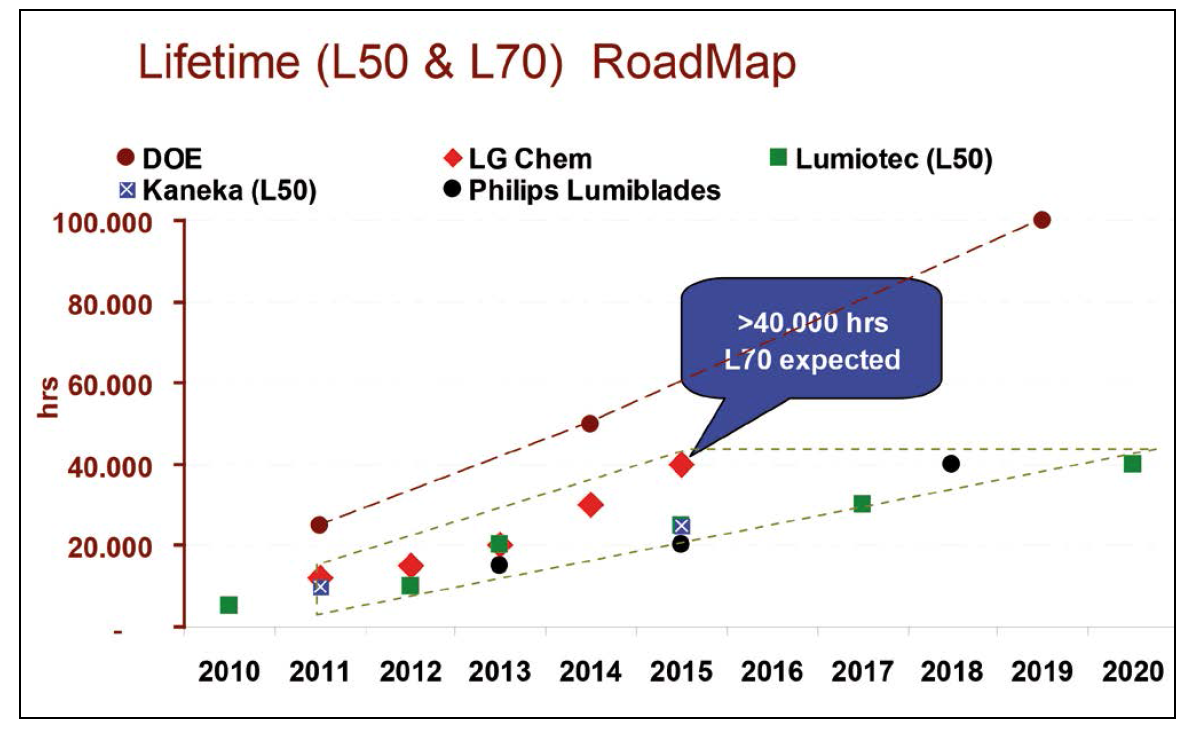

The graph in figure 4 shows some roadmaps looking just a little ahead and the outlook for 2015 is an L70 of 40,000 hours which would put OLEDs closely in the wake of LEDs.

This is the target declared by LG Chem. But it is also an incentive for many others to follow.

Figure 4: Roadmap of some OLED manufacturers with reference to lifetime

Figure 4: Roadmap of some OLED manufacturers with reference to lifetime

Costs – the Major Issue

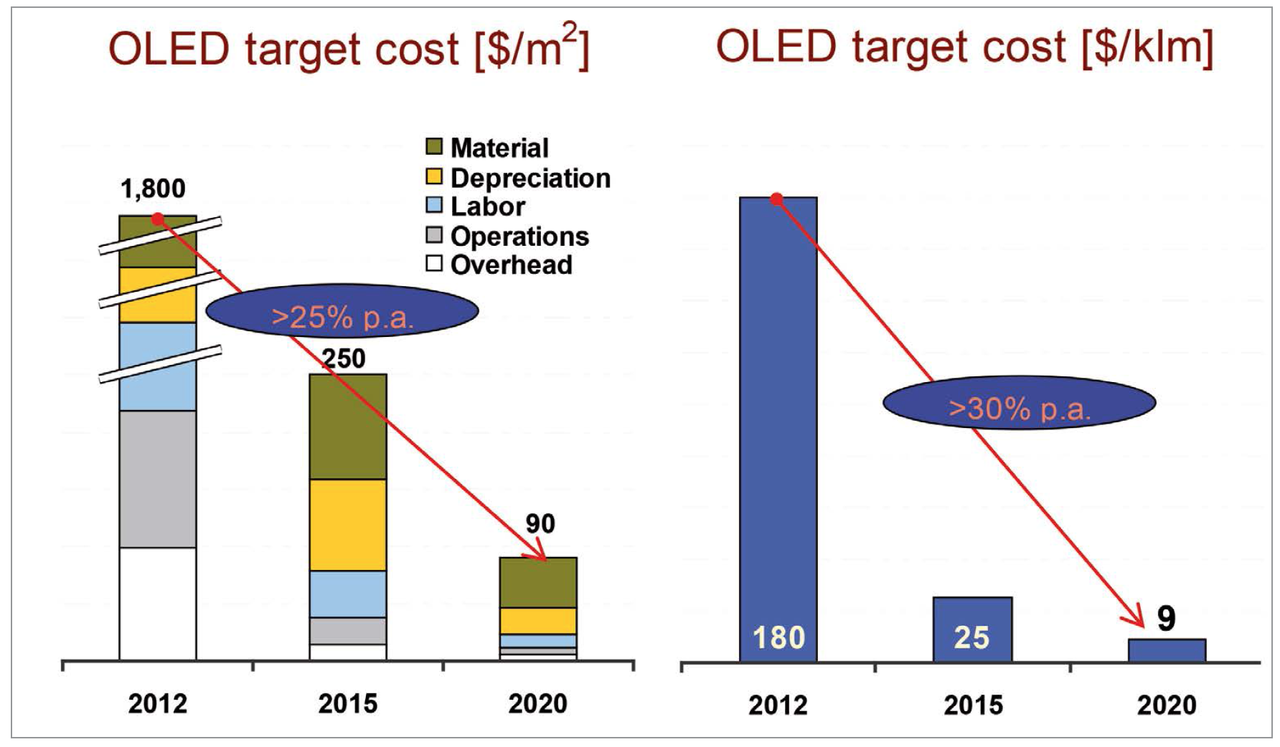

According to the DoE, “OLED production costs will drop 25% a year from 2012 to 2020”. Costs are the most crucial issue of this product panorama. They are still seemingly exorbitant and the manufacturers are not making any forecasts.

Many of the products on the market have been manufactured on lines which may be defined as R&D, in other words, almost handmade products.

For example, a 10 x 10 cm2 panel by Lumiotec costs $130 and produces 55 lm resulting in a cost of ~$2,700/klm.

A kit by Philips containing three GL350s costs $520 and produces 360 lm which translates into $1,500/klm.

Lines specifically dedicated to volume production are being started up today, for example, by LG Chemical, and the R&D lines of Osram and Philips have been boosted to make commercial production possible. The prices should sink significantly once these lines reach their maximum production capacity.

In the meantime, the projections of the DoE (American Department of Energy) are deemed valid since their roundtable discussion with major manufacturers. The discussions helped them understand the manufacturers’ outlook for the future.

The ensuing forecasts are shown in figure 5. Both the production cost expressed in dollars per square meter (graph on the left) and the cost evolution expressed as dollars per kilo-lumen are shown.

Figure 5: Medium/long-term projections from the last OLED roundtable held by the American Department of Energy

Figure 5: Medium/long-term projections from the last OLED roundtable held by the American Department of Energy

According to the first graph, the production cost should go from $1800/m2 in 2012 to $250 in 2015 to then drop to $90/m2 in 2020: an 86% reduction in the first period and another 64% in the second, that is, an average annual reduction of more than 25%.

What will draw the most attention is the $/klm data, which immediately leads to comparing it with the same parameter we are used to seeing for LED price projections, which today, again according to the DoE, would be around 18$/klm.

However, this approach is partially misleading as it DoEs not take into account that when designing a lighting system using OLEDs, two particularly important problems are eliminated:

• The heat problem

• The need for optics

To solve the heat problem in an LED application, a heat dispersion structure is required, which carries significant weight. According to the DoE, thermal management carries a weight of almost 30% of the total lighting system.

The need for optics arises from the almost punctiform nature of LED sources. Therefore, light beam distribution requires optics that absorb part of the luminous flux (3-5%) but add costs to the system.

Color Consistency and CRI

CRI, or color rendering index, expresses the capability of a light source to make the colors of an illuminated object recognizable.

Often indicated with the symbol “Ra”, it is determined by quantifying and averaging the visual difference between the test colors (R1 - R15) when illuminated by a reference source or by the source being assessed. The closer the index is to 100 the greater the capability to reproduce the colors of the source under test.

All the products described have a CRI above 80 while the Philips GL350 offers a CRI above 85, and the projections show values largely above 90. The Lumiotec P06 series arrives at a Ra of 93.

Physical Properties

Dimensions

Taking the square shape as a reference and considering the emission surface area, today the GL350 comes in the size 104 × 104 mm2, the LG Chem panel is 90 × 90 mm2 (but they’ll be bringing out a 130 × 130 mm2 panel within the year), while the Orbeos is round in shape with an active area of 80 mm in diameter.

At any rate, all the manufacturers are working towards making bigger sizes and, for example, LG Chem should bring out a 300 × 300 mm2 (outside dimensions) panel between 2014 and 2015.

Flexibility

Because, right now, there is at least one glass wall, it means that the available panels are rigid. However, on this front, everyone is working towards a flexible version.

LG Chem has promised a flexible version of a 200 × 50 mm2 panel by the end of the year.

Philips too has declared its commitment in this direction. Flexibility, even if limited, would offer designers a new dimension to adapt their projects to the environment.

Production and Manufacturing Capacities of OLEDs

Having looked at all the more or less critical aspects of the technology, the question that remains is: “Will it have the power to conquer the market and will sufficient manufacturing capacities be provided?”

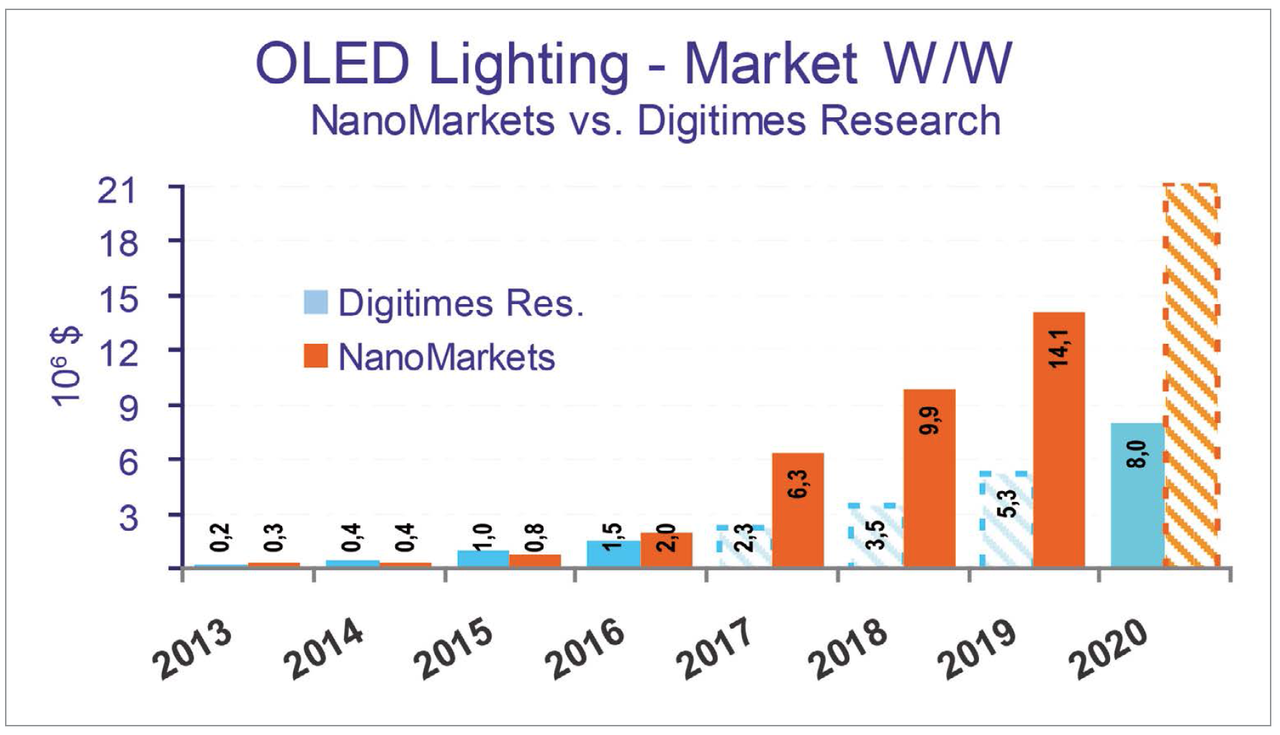

Figure 6 compares the forecasts of two expert analysts in the sector:

Digitimes Research and Nanomarkets. The two forecasts are quite contradictory: the most optimistic, that of Nanomarkets, talks about an OLED lighting market of 21 billion dollars in 2020 while Digitimes stops at 8 billion, almost a third.

It is interesting to read the introduction to the data presented by Nanomarkets of which we give the salient points below.

“In the proposed scenario, the technical progress, the cost reduction and the investments made were deemed positive. The main manufacturers of OLEDs for lighting have made significant headway in their development efforts, especially on the performance front. But, going from here to the proposed scenario will still take a lot of work on the technical development and marketing front in the next five years.

Several challenges still remain, including improvement of performance, reduction of costs, standardization and expansion of the production capacity. If the industry overcomes these challenges, then OLED lighting can become the next ‘big thing’ in lighting.

Nanomarkets believes that the proposed scenario cannot be realized unless a champion of the industry emerges and invests in the sector despite the risks. A company that not only has broad shoulders, but is also well consolidated in the lighting world so as to be able to capitalize on an existing supply chain in order to bring OLEDs to the mass market”.

Figure 6: OLED Lighting W/W Market forecasts - Nanomarkets vs. Digitimes Research

Figure 6: OLED Lighting W/W Market forecasts - Nanomarkets vs. Digitimes Research

Final Considerations

To date, potential saviors are a select group of companies, including: GE, Osram, Panasonic (together with Mitsubishi), LG Chemical, Philips and Samsung. Although GE has thrown in the towel, it can always make a comeback.

There is also a firm possibility that this OLED champion will emerge from Korea where both LG and Samsung are creatures of the country’s industrial policy. Rumor has it that pursuant to Korea’s industrial policy, Samsung has been chosen as the champion of OLED displays while LG is the champion of OLED lighting.

The other two companies nominated to emerge as champions of OLED lighting are Philips and Osram, in the sense that they were the first to realize pilot lines and develop products. They also participate in various projects financed by the European Community.