Yole Développement Releases QD & Wide Color Gamut Display Technologies Report

“As TV makers struggle to trigger replacement cycles, WCG and HDR and their notable picture quality improvements are the next growth drivers for the TV industry,” announces Eric Virey, Senior Market & Technology Analyst, LED, Sapphire & Displays at Yole Développement (Yole).

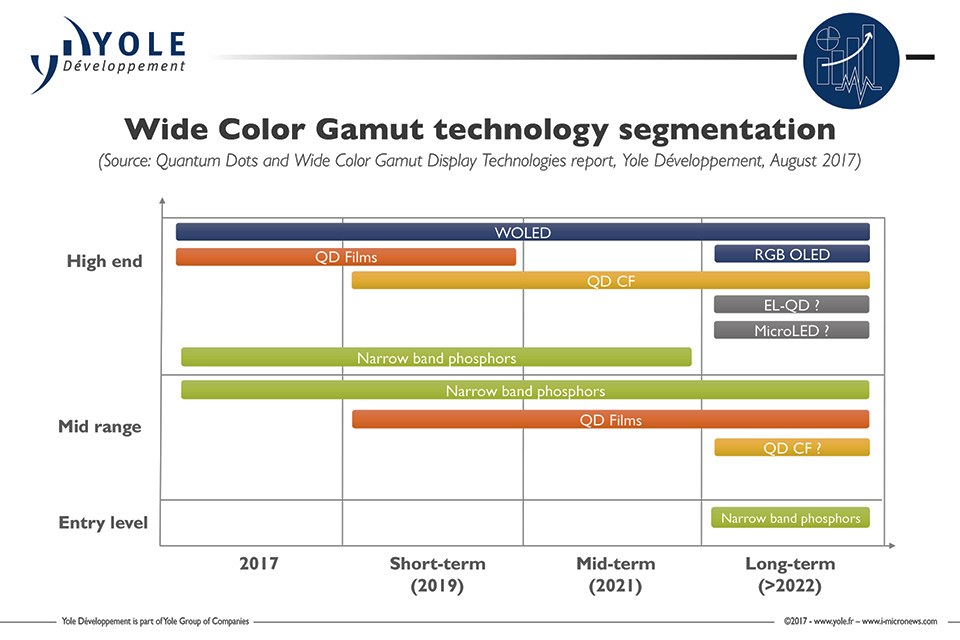

Various technologies are competing to deliver those features. In the short and mid-term, the best-positioned ones are OLED and the well-established, dominant, LCD technology supercharged with narrow-band phosphor LEDs or QD color converters in the backlight unit. Yole analysts delivered a deep analysis of the WCG display and QD technologies, status and prospects, roadblocks and key players with a dedicated technology & market report titled: Quantum Dots & Wide Color Gamut Display Technologies.

What is the status and benefits of QD technologies? After QD-Vision demise , what are the companies that can answer to the demand of the fast growing LCD market? How will the competitive landscape evolve, especially with OLED solutions? The “More than Moore” market research and strategy consulting company Yole offers you a snapshot of the QD technologies, its applications and the players involved.

Quantum Dots enable drastic enhancements of display color gamut. They do so with high efficiency, giving display makers headroom to increase brightness, contrast and gamut without increasing power consumption.

Their most common implementation is as color conversion films located in the LCD backlight unit. In this form, QDs are drop-in solutions that can be easily deployed on all sizes of displays without any process change or CapEx . QDs therefore enable the LCD industry to boost the performance of its products without major investment. This contrasts with OLEDs, which require building multibillion-dollar dedicated fabs.

However, QDs do not solve some of LCD shortcomings. Mostly, LCD still lag behind OLEDs in terms of response times, black levels and viewing angles. Also, LCDs cannot deliver pixel-level dimming, the strongest selling point for OLED displays. In the near future, QDs could substitute for LCD color filters. Unlike films, this configuration requires some process changes in LCD manufacturing. However, it would double the display efficiency, further improve color gamut and provide viewing angles similar to OLED. In the longer term, EL-QD could deliver OLED-like characteristics and performance, with improved brightness and stability.

“QDs and related technologies will take advantage of OLED TV capacity constraints,” says Dr Eric Virey from Yole. LG Display is currently the only OLED TV panel manufacturer. The company announced that it will stop investing in LCD and build two new OLED TV manufacturing lines in Korea and China, slated to start production in late 2019. Cost and technology barriers to entry are high, and few other companies will be able to manufacture OLED TV panels in that timeframe. Unless OLED printing technologies progress fast enough to enable cost efficient manufacturing of large, full RGB displays, OLED TV adoption will therefore remain capacity-constrained to less than 12 million units per year until 2022.

QDs will take advantage of this window of opportunity to capture the lion’s share of the WCG and HDR TV market. Rapidly improving performance and decreasing cost is already enabling adoption to spread into mid-range, sub-US$1000 models opening a high volume markets still forbidden to OLED for cost and capacity reasons. Display makers will use QDs to keep extracting more value from existing LCD fab. For the long term, many are hedging their bets and looking at both RGB printed OLED and EL-QDs.

In the mid-term however, QDCF configurations represent an attractive opportunity to close the gap with OLED in term of viewing angles and widen it in term of gamut and efficiency. QDCF however requires some LCD manufacturing process changes. Although moderate compared to a new OLED fab, not every LCD maker will want to commit the required CapEx or even develop the technology.

In the longer term, both OLED and QD-enhanced LCD could face competition from new, disruptive technologies such as the already mentioned electroluminescent QDs or even microLEDs, which could drive a potential paradigm shift, offering alternatives to OLED in self-emissive display technologies. Other technological innovations could also disrupt the QD market. For example, commercialization of a narrow-band green phosphor could eliminate the performance gap between phosphors and QD films and enable a more cost-effective solution.

A detailed description of Yole’s Quantum Dots & Wide Color Gamut Display Technologies report is available on i-micronews.com, display reports section.

About Yole Développement:

Founded in 1998, Yole Développement has grown to become a group of companies providing marketing, technology and strategy consulting, media and corporate finance services. With a strong focus on emerging applications using silicon and/or micro manufacturing, the Yole Développement group has expanded to include more than 50 collaborators worldwide covering MEMS, RF Electronics, Compound Semiconductors, LED, Displays, Image Sensors, Optoelectronics, Microfluidics & Medical, Advanced Packaging, Manufacturing, Nanomaterials, Power Electronics and Batteries & Energy Management. The “More than Moore” company Yole and its partners System Plus Consulting, Blumorpho, KnowMade and PISEO support industrial companies, investors and R&D organizations worldwide to help them understand markets and follow technology trends to develop their business.