Phosphors & QDs LED Downconverters Report for Lighting & Displays from Yole Développement

“Volume saturation, price pressure and a shifting intellectual property landscape are forcing the LED phosphor & QDs industry into a rationalization phase,” announces Dr. Eric Virey, Senior Technology & Market Analyst, Yole Développement (Yole).

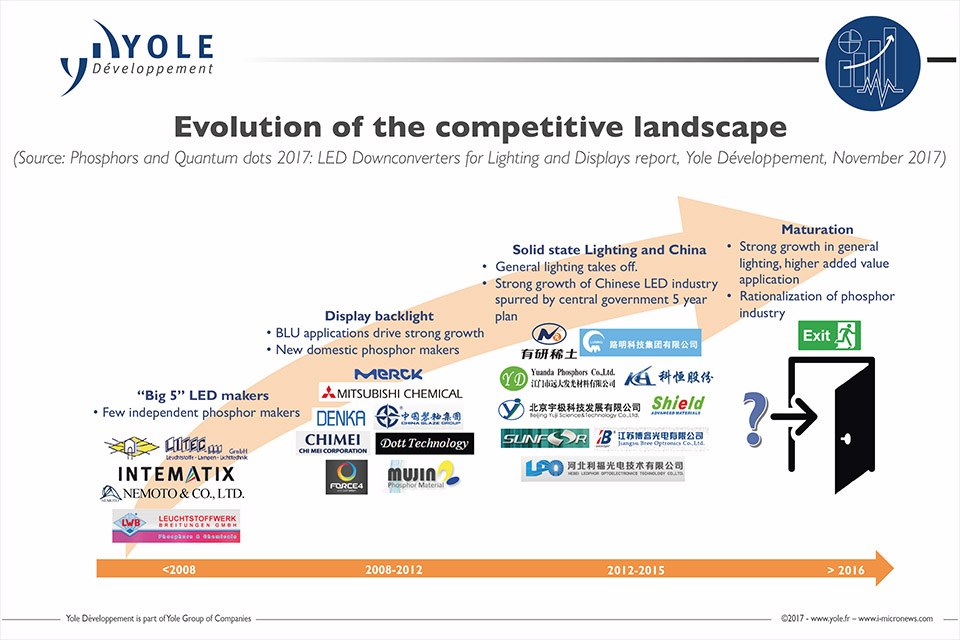

Therefore, in this environment, Yole is expecting further rationalization of the industry landscape with tier 2 and 3 companies exiting the business. Most of those companies do not have any elements of differentiation, be it on performance or manufacturing cost that could allow them to survive in the mid and long term. For most phosphor suppliers, the name of the game is to keep decreasing costs as volume increase and revenue remain essentially flat. But despite increasing commoditization, the LED phosphor & QDs industry still offers opportunities for innovative companies to strive. While price ranges for established composition will narrow, a significant gap between low end and top performers will persist. This will enable some suppliers to keep capturing significant added value. The LED industry still has unmet needs in terms of phosphors. Companies able to develop and commercialize new narrow-band red and, to a lesser extend, green materials might still hit the jackpot…

The “More than Moore” market research and strategy consulting company Yole released today its Phosphors & QDs report: Phosphors & QDs: LED Downconverters for Lighting & Displays. This new report is offering a comprehensive review of the LED downconverter markets, technology trends, competitive landscape and price trends. Detailed volumes and revenue forecast are provided for each downconverter group, phosphors and QDs. Moreover, Yole’s analysts provides an overview of the key requirements and specifications for use in the major LED applications: lighting and displays and much more. A complete description of this technology & market analysis is available on i-micronews.com, LED reports section.

IP and commoditization are reshuffling the cards in the LED QD and phosphor markets. Yole’s analysts invite you to enter into the lighting world.

Saturating volume and continuous price pressure creates a challenging environment for phosphor suppliers. Indeed, after five years of cut-throat competition that has driven prices to levels that nobody would have believed sustainable just a few years back, phosphor prices slowed their free fall in 2016.

After experiencing a proliferation of new entrants in China in the 2012-2015 period, the phosphor & QDs market has entered in a new phase: with increasing demand for quality, consistency and customizations, the weakest players are exiting the market. Surviving companies have sizable R&D effort and long term expertise in researching, developing and manufacturing phosphors. Leading suppliers have also developed closer relationships with LED packaging companies, enabling a virtuous circle of co-development and feedback loops enabling further performance improvement.

The competition remains strong. Price, performance and ability to customize products for a specific need are strong element of differentiation.

The analysts from Yole explain:

• A market can often be lost for a 1% difference in performance

• Phosphors need to be optimized and customized for each product: a phosphor delivering top performance for one package at one customer might underperform in another package

• The final performance of a phosphor in a LED package can vary based on parameters that are out of the control of the supplier: binder type, viscosity, mixing and dispensing method, procedures etc. To ensure optimum performance, close collaboration between the phosphor maker and the LED packager is required.

Regarding the current leading suppliers such as MCC, Intematix, Denka and other, Yole confirms their good market position. All of them remain on the top but strong companies are emerging in the Chinese market. While still focused on the domestic market, the consulting company is expecting some to become credible global players within the next 3 years. For example: Grirem, Yuji, Shield…

In parallel, Yole highlights the IP status of this industry. Key patents held by Nichia and Osram have started expiring in 2017 and will continue to do so in 2018. While both companies have since built on those patents and created broad families of intellectual property (IP), it will become much more difficult for them to prevent competitors from using garnet phosphors in their LED packages.

The Report in Detail:

EXPIRATION OF FUNDAMENTAL INTELLECTUAL PROPERTY CHANGES THE MATERIAL LANDSCAPE:

Key patents held by Nichia and Osram have started expiring in 2017 and will continue to do so in 2018. While both companies have since built on those patents and created broad families of intellectual property (IP), it will become much more difficult for them to prevent competitors from using garnet phosphors in their LED packages.

As a result, phosphor families such as silicates and yellow nitrides (LYSN) are expected to lose market share as LED packagers transition to garnets. The switch will especially affect silicates, which are perceived to have lower performance than yttrium aluminum garnet (YAG) and other garnets, However, some of the most recent silicate compositions developed by tier-1 suppliers are now matching YAG performance but come at a premium price. Leading phosphor suppliers with a strong focus on silicate materials must therefore diversify their portfolio. They need to create new silicate compositions with unique features to meet specific demands in various high added value lighting applications.

LYSN might fare better in the long term. Yellow nitrides have exhibited steady and continuous performance improvement since entering the market in 2010. The material is already matching garnet performance in most aspects and, being less mature, still offers significant room for improvement. Attractive features of yellow nitride include a lower infrared tail that could translate to higher efficiency compared to YAG. Leaders in nitride phosphors could therefore find a new growth driver as the red nitride market reaches saturation.

QUANTUM DOTS HAVE FINALLY TRANSITIONED FROM A SCIENCE PROJECT INTO A BILLION-DOLLAR INDUSTRY AND NEW PHOSPHORS ARE EMERGING:

For wide color gamut (WCG) TVs and monitors, potassium fluorosilicates (PFS/KSF) and phosphors in general are being challenged by quantum dots (QDs), which are gaining rapid acceptance. In 2017, QDs can be found in 47% of WCG TVs. QDs deliver the best color gamut and higher efficiency, allowing LCD TV manufacturers to deliver improved image quality rivaling that of OLEDs in many regards without having to invest in new fabs.

QDs are therefore set to dominate the rapidly emerging market for high performance WCG TVs and monitors. However, the emergence of a narrow-band green phosphor with the appropriate center wavelength could challenge this dominance and disrupt the market.

QDs have also made significant progress toward “on-chip” configurations. Lumileds and Pacific Light Technology have demonstrated the first commercial grade, high color rendering index (CRI) mid-power LEDs based on high-stability QDs. However, more work is needed to reduce the cadmium content to levels meeting international regulations on heavy metals. The technology could be ready for 2019 but whether or not LED makers will be willing to adopt a downconverter solution containing cadmium will depend on the performance gap that those QD-based LEDs will deliver compared to traditional phosphors.

In displays new phosphor compositions have also rapidly gained market share. After the rise of green silicon aluminum oxygen and nitrogen compounds (SiAlONs), red nitrides are being displaced by PFS which has already captured a 34% share in WCG TVs.

SATURATING VOLUME AND CONTINUOUS PRICE PRESSURE CREATES A CHALLENGING ENVIRONMENT FOR PHOSPHOR SUPPLIERS:

After five years of cut-throat competition that has driven prices to levels that nobody would have believed sustainable just a few years back, phosphor prices halted their free fall in 2016.

The most mature compositions such as garnets have reached bottom. However, nitride, oxynitride and KSF still have room for significant decline that will offset modest volume growth as the LED market reaches saturation toward the end of the decade.

In this environment, we expect further rationalization of the industry landscape with tier-2 and -3 companies in China exiting the business. Most of those companies don’t have any elements of differentiation, be it on performance or manufacturing cost, that would allow them to survive in this business in the mid- and long-term. However, a handful of domestic players such as Grirem or Yuji Science are emerging as long term credible competitors alongside established leaders such as Intematix and Mitsubishi Chemical.

For most phosphor suppliers, the name of the game is to keep reducing costs as volumes increase and revenue remain essentially flat. However, the LED industry still has unmet needs in terms of phosphors and new trends and applications such as high CRI lighting and human-centric lighting are generating new demands for efficiency and spectral engineering.

Companies able to develop and commercialize new narrow-band red and, to a lesser extent, green materials could last long-term if they can secure their innovations with strong intellectual property. Other needs, such as good cyan phosphors and red ceramics, could enable more companies, including new entrants, to succeed in this challenging market.

Despite increasing commoditization, the LED phosphor industry therefore still offers opportunities for innovative companies. While price ranges for established compositions will narrow, a significant gap between low end and top performers will persist. This will enable some suppliers to keep capturing significant added value through improved material performance, consistency, ability to deliver highly customized products and strong IP.

For additional information, you may visit Yole's i-Micronews Website.

About Yole Développement:

Founded in 1998, Yole Développement has grown to become a group of companies providing marketing, technology and strategy consulting, media and corporate finance services. With a strong focus on emerging applications using silicon and/or micro manufacturing, the Yole Développement group has expanded to include more than 50 collaborators worldwide covering MEMS, RF Electronics, Compound Semiconductors, LED, Displays, Image Sensors, Optoelectronics, Microfluidics & Medical, Advanced Packaging, Manufacturing, Nanomaterials, Power Electronics and Batteries & Energy Management. The “More than Moore” company Yole and its partners System Plus Consulting, Blumorpho, KnowMade and PISEO support industrial companies, investors and R&D organizations worldwide to help them understand markets and follow technology trends to develop their business.