Research and Markets Announces OLED Lighting Opportunities 2015-2025 Forecast

OLED lighting is an emerging solid-state lighting technology. It potentially provides a route into the large and growing global lighting market. The lighting market is however complex as it is a highly fragmented space thanks to the existence of a broad technology mix and a diversity of customer needs.

The market segments include residential, office, industrial, outdoor, hospitality, shop and automotive. Each sector attaches a different degree of importance to upfront cost, energy efficiency, lifetime, light intensity, colour warmth and design features. This explains why the technology mix in each sector is different.

The report assess the market potential for OLED lighting across all major lighting sectors. We forecast that the market will grow to 1.9 billion USD in 2025 (optimistic scenario). The market growth will however be very slow until 2019 where the overall sales at panel level will remain below 200 million USD globally.

Our forecast is segmented by sector. We find that architectural, hospitality and shop segments will be the first to grow as the prize design parameters the most. Automotive is also promising given the recent announcements by companies like BWM but lifetime and reliability still need to be improved. Residential, office, and outdoor to follow later once cost decreases and lifetime is prolonged.

OLED lighting has the potential to efficiently emit warm light across large surfaces and to bring new and novel form factors into the lighting sector. These are strong selling points on their own but the challenge is in that they are not always unique.

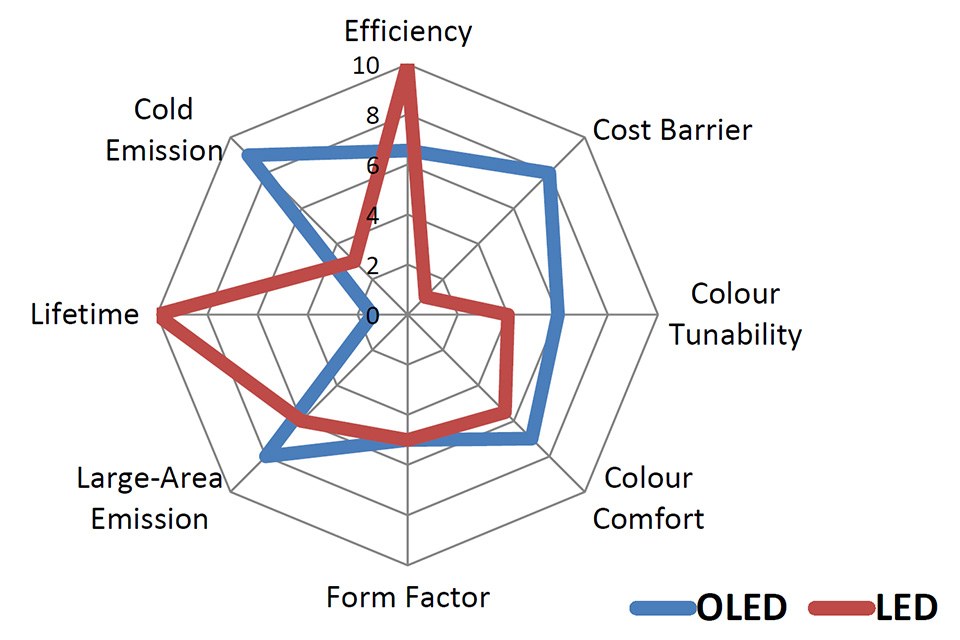

In particular, inorganic LED lighting has arrived first onto the market. Its technology, cost structure and supply base have dramatically improved, opening a large performance and cost gap between LEDs and the younger OLEDs. The performance gap has not drastically narrowed despite progress in OLEDs with companies such as Konica Minolta reporting champion 131 lm/W panels.

The challenge facing OLEDs is therefore identifying paths for differentiation. The differentiation challenge is also critical strategy question because many companies such as Osram and Phillips Lighting already have successful and growing business in the LED sector. Investment in OLED can provide a hedged bet and also a means of standing out in an increasingly commoditised LED market.

Surface emission is a possible differentiator although inorganic LEDs are also able to create effective surface emissions, despite being a point light source, thanks to waveguides. Flexibility is also another way although OLEDs themselves also face critical technology challenges that stand in the way of them achieving flexibility. However, the pressure building up in the value chain combined with commitments from large players such as Konica Minolta and LG Chem suggests these barriers are nearly resolved. The ability to offer customised or improved design features is also a selling point. In particular, the potential to act at the luminaire level as a slightly modified panel can be a competitive advantage.

Technology assessment:

Authors of the report have been tracking the market for OLED lighting for several years. We have provided a comprehensive and detailed technology assessment section. Here, we cover both LED and OLED lighting technologies, assessing the fabrication processes, material compositions, technology roadmaps, and key players.

Moreover, we appraise the device attributes of each technology and examine parameters such as colour warmth and controllability, flexibility, efficiency, surface emission, lifetime, wafer size and luminaire design.

Critically, authors of the report also have strong knowledge on enabling technologies in the OLED lighting ecosystem such as emerging thin film barrier/encapsulation technologies or transparent conducting films. For example, we have interviewed or visited 20 companies commercialising barriers including thin film, ALD and flexible glass technologies, and more than 27 suppliers working on a variety of transparent conducting film technologies such as silver nanowires, metal mesh, carbon nanotubes, etc.

Market assessment:

The second part provides a detailed assessment of the market. Here, we provide ten-year market forecast segmented by lighting sector at the panel level. Our market forecasts are expressed in value, area coverage and also equivalent unit numbers. We also provide cost projections in $ per sqm and $ per klm split by the layer (OLED materials, encapsulations, integrated substrates, etc).

Moreover, we provide critical assessments of the value proposition of OLED technology in each lighting sector and use our analysis to build up our market share forecasts in each segment. Here, we analyse parameters such as light quality, technology mix diversity, price sensitivity, light controllability, lifetime and light intensity. Furthermore, we provide the latest industry updates and profiles on players in the industry such as Panasonic, LG Chem, Osram, Phillips Lighting, Sumitomo Chemical.

Further details:

For additional information, please visit the OLED Lighting Opportunities 2015-2025 micro page.

For other information and reporte, please visit www.researchandmarkets.com